For debts like credit cards, medical bills, timeshare contracts, and payday loans, our legal staff can explain the short and long-term differences between debt settlement and bankruptcy. Did you know that most of our clients can have a 700 credit score in as little as 24 months after bankruptcy? Did you know that some people can get out of debt without bankruptcy? At Tradebloc, we’re not a bankruptcy or loan modification “mill” trying to rush you into any hasty decisions that may not be the right move for you and your family.

For debts like credit cards, medical bills, timeshare contracts, and payday loans, our legal staff can explain the short and long-term differences between debt settlement and bankruptcy. Did you know that most of our clients can have a 700 credit score in as little as 24 months after bankruptcy? Did you know that some people can get out of debt without bankruptcy? At Tradebloc, we’re not a bankruptcy or loan modification “mill” trying to rush you into any hasty decisions that may not be the right move for you and your family.

Tradebloc has helped 6,189 clients renegotiate completely out of their contracts with creditors, paying nothing out of pocket in just the last 12 months alone.

YOU HAVE RIGHTS

Much like a professional athlete or television star, you have the right to attempt to renegotiate any contract at any time. In essence, that’s what debt settlement is: a renegotiation of what you owe a creditor to a lower amount or an outright release from the contract itself. Debt settlement can get you out of debt without bankruptcy.

Now, contract negotiation can be tricky at times, and that’s why athletes and actors have teams of agents and attorneys to handle it for them. At Tradebloc we’re your agent and your legal counsel. We’ll negotiate with your creditors to reduce the amount you owe or release you completely from your obligation. This is very different from debt consolidation or even credit counseling who’s goal is to lower interest rates or payments. Our talented legal staff will work tirelessly to get you released from your contracted obligations altogether.

Tradebloc’s legal staff have experience with a bankruptcy AND debt settlement. During your consultation, they’ll explain the benefits and differences between both services rather than try to force you into one or the other like some law firms do. Don’t go to a lawyer that only does bankruptcy. Get all your options.

Debt Settlement is a contract negotiation between a creditor (or debt-collector) and a debtor (or the debtor’s legal counsel). The goal of this negotiation is to convince the collector to take a small portion of the debt if not no monies as Payment-In-Full. Also, the paperwork that accompanies the settlement offer should ensure that the balance is marked down to zero, and no one can EVER try to collect on that account again. Sometimes debt settlement is used to avoid bankruptcy, but in other cases, financially savvy clients just want to get out of debt with as little out-of-pocket as possible.

Tradebloc will handle all communications and negotiations with your creditors and debt collectors. At Tradebloc, we handle all types of settlement cases and will build a plan that works for your situation. If you have $10,000 or more in debt, such as credit card debt, medical bills, payday loans, outstanding timeshare contracts, and personal loans, you should consider debt settlement. This is true regardless of whether or not you’re considering other debt-relief solutions like bankruptcy or debt consolidation. The fact is, debt settlement is the ONLY way to get rid of your debt for less than you owe WITHOUT putting a bankruptcy on your credit score. If you ARE considering bankruptcy, you should DEFINITELY consider debt settlement before filing. At Tradebloc, we handle debt settlement AND bankruptcy. You can be sure that we’ll guide you toward the right solution for you.

In America, any party to a contract has the right to attempt to negotiate better terms at any time. Credit card agreements, medical service agreements, timeshare contracts, and payday loans are contracts like any other. In most cases, credit card bills, medical debts, payday loans, timeshare contracts, and second mortgages (HELOCs) qualify for some level of debt settlement. If you have other types of debt (student loans, tax debt, mortgages) a good debt relief firm may be able to provide you with options to take care of those, too.

It’s a balance sheet thing. When a debt is settled, it moves out of the “Accounts Receivable” column and splits into two parts; the “Income” column and the “Loss” column. Companies use those “losses” to offset other items (including any payment on your debt) and reap the benefits of creative accounting. This is sort of like donating an old car to charity: The car is worthless to you, but it’s $2000 to the charity. You get to deduct that $2000 off your income when you prepare your taxes. In addition, when those who also practice bankruptcy law negotiate settlements, creditors fear that you might be a candidate for bankruptcy; they may get no money at all if you file. Creditors jump to settle debts with Tradebloc because they fear a potential bankruptcy.

The duration of a debt settlement varies from situation to situation, however most Tradebloc debt settlement cases are completed in less than 12 months.

WHAT IS BANKRUPTCY?

Many people struggle to make ends meet. You may be living month to month, or from paycheck to paycheck, without ever feeling financially secure. Maybe you’re already behind on your bills and debt collectors are harassing you day and night. Whether your debts grew gradually overtime or an unexpected event like job-loss or illness brought on debts that are out of control, the nation’s bankruptcy laws exist to give people a chance at a fresh start. They can give you the breathing room you need to get a handle on your finances.

IMMEDIATE RELIEF!

As soon as you file bankruptcy, your creditors are barred from contacting you or taking action against you or your assets. This means that the bill collector calls STOP, and any FORECLOSURE or REPOSSESSION is halted immediately. Not only does filing bankruptcy get rid of your debt, but it can also give you time to decide what to do with your home, vehicle, or timeshare.

WHY WAIT?

If your debt is getting out of control, and you’d like to know more about debt settlement or bankruptcy, call us today at 800-554-7694 to schedule your consultation with one of our experienced legal professionals!

Adam J. Wax, Esq.,

Nevada Bar #12126

Licensed:

Nevada Federal Courts (2010)

9th Circuit Court of Appeals (2019)

United District Court for the District of Nevada (2010)

Adam Wax Law Firm.

An independent law firm that will provide effective representation to benefit the success of our clients. Mr. Adam Wax will handle a broad range of legal issues pertaining to the needs of our clients by helping resolve disputes, settlements, and negotiate contracts.

Adam has been admitted to practice law and remains in good standing in both the State of Nevada and the United States District Courts. Adam earned his Bachelor of Arts degree in Political Science, with a Minor in Law and Society, from the University of Southern California (USC) in 2006. He received his Juris Doctorate degree from the William S. Boyd School of Law in 2010.

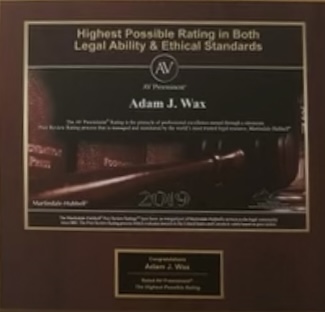

Adam has been named a Mountain States Rising Star by Super Lawyers Magazine, a member of the Legal Elite by the Nevada Business Magazine, a Top 100 Trial Lawyer by The National Trial Lawyers, and one of the Top 40 Litigation Lawyers Under 40 in Nevada by the American Society of Legal Advocates. Martindale-Hubbell® awarded him the highest possible rating of AV® Preeminent™ for ethical standards and legal ability.